New: CKYC Automation

Onboard Customers with Minimum Drop-off Rate

AI-powered, compliant customer onboarding - fast, secure, and seamless with AIFISE

Face Scanning...

Already trusted by industry leaders

What AIFISE?

AIFISE OMNI

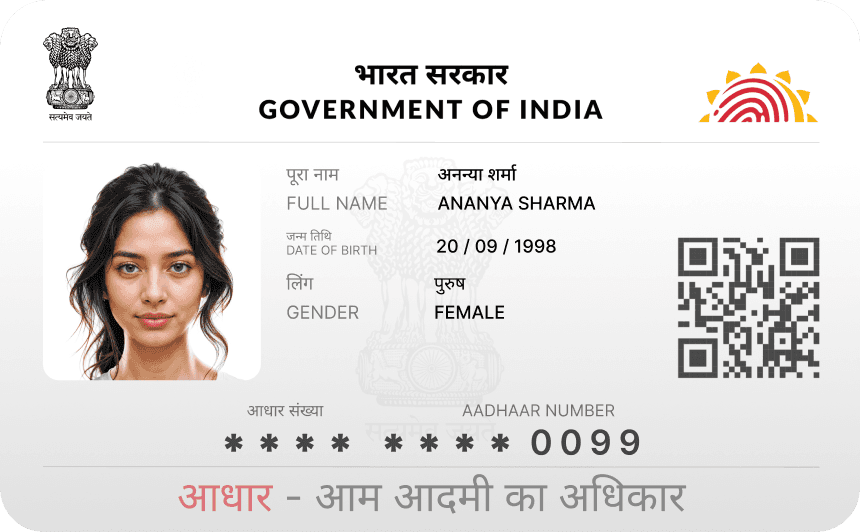

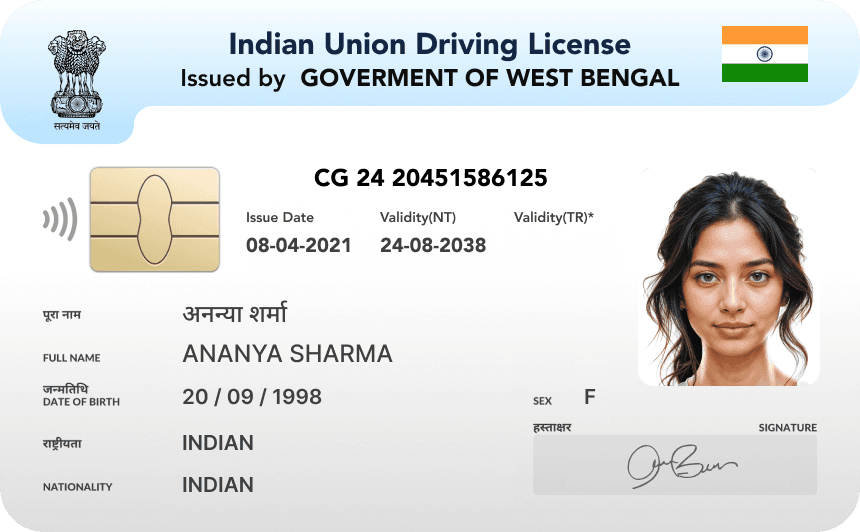

Customer Identity Verification

Check IDs in seconds—in any script, with 14,000+ supported IDs. AIFISE extracts data in any language, detects document edges for easy capture, and pre-screens IDs for user errors. Government and commercial database checks can add extra security.

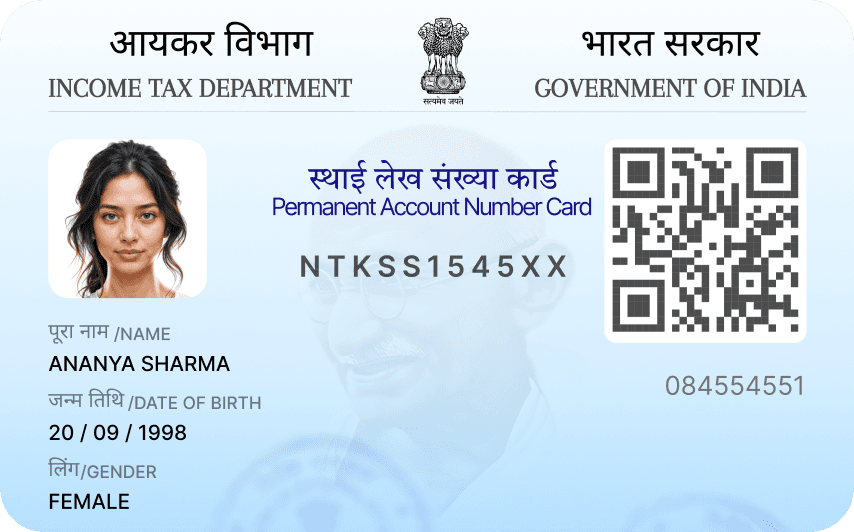

PAN NSDL API

Instantly verify PAN details with real-time NSDL checks, ensuring accuracy and compliance in seconds.

Face Match

Instantly verify identities by matching facial features against databases, detecting deepfakes, AI-generated faces, masks, and duplicates in seconds.

Application Data Validation

Verify data authenticity by cross-referencing government and commercial databases, adding an extra layer of fraud prevention.

AIFISE OMNI

Digital KYC

Want stricter compliance? In addition to AI based KYC, AIFISE offers 3-4 minute live video interviews. Users start the call anytime, anywhere. An agent collects documents, asks questions, and makes a decision. Results are shown instantly. AIFISE handles it all, so you can focus on your business.

Digilocker

Securely fetch and verify government-issued documents in seconds, ensuring faster and paperless KYC compliance.

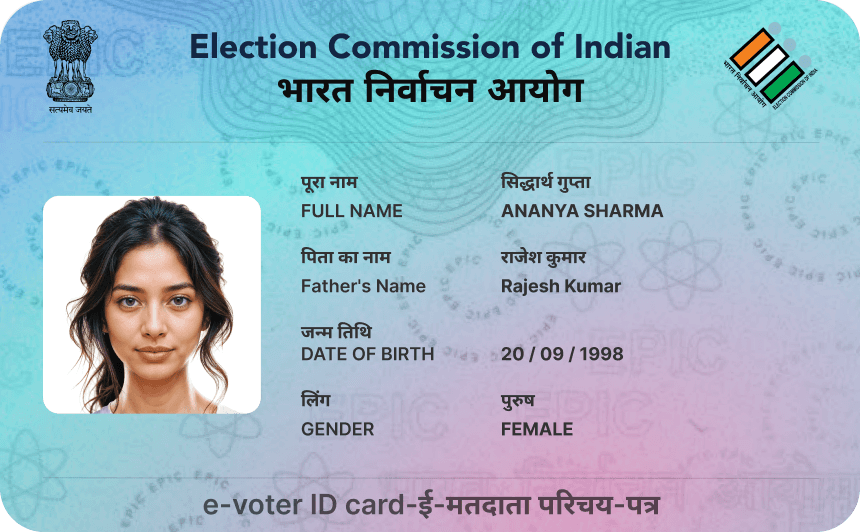

e-KYC

Instantly verify customer identities using Aadhaar-based authentication, reducing onboarding time and ensuring regulatory compliance.

Video KYC

Conduct live video verification with real-time document collection and identity checks, ensuring secure and compliant remote onboarding.

AIFISE OMNI

Customer Address Verification

Verify the address in less than 1 minute to avoid drop-offs. Alternatively, use database or geolocation checks. AIFISE will check documents for authenticity, image integrity, and data validity, including expiration dates and address existence.

Address Match AI

Instantly validate addresses by comparing document data with verified databases, ensuring accuracy and reducing errors.

TELCO API

Verify customer addresses using telecom data for faster, reliable validation without additional documents.

Geo-Based Address Validation

Confirm address authenticity by matching user location with provided details, ensuring real-time verification.

AIFISE OMNI

Employment Verification

Create a 10X faster verification and onboarding experience for your employees with end-to-end background checks. Our background checks ensure the fastest turnaround time so you can scale up at speed and save onboarding time and operational costs by up to 70%.

EPFO

Instantly verify employment history and contributions using EPFO records, ensuring accurate and reliable background checks.

Salary Slip

Validate salary details with AI-powered data extraction, ensuring document authenticity and income accuracy.

GST

Verify business employment status through GST registration data, ensuring compliance and legitimacy.

AIFISE OMNI

Income Verification

Income verification reports confirm an applicant’s proof of funds against their bank statements, making it difficult for applicants to falsify their financial documents.

Account Aggregator

Securely access and verify financial data from multiple banks, ensuring accurate income assessment in real time.

Bank Statement Analyser

Instantly analyze bank statements to verify income patterns, cash flow, and financial stability with AI-driven insights.

Salary Slip Analyser

Extract and validate salary details from payslips, ensuring authenticity and preventing document tampering.

AIFISE OMNI

Data Protection

Safeguard sensitive customer information with advanced security features that prevent data misuse and ensure compliance. AIFISE protects documents and images during verification, maintaining privacy and confidentiality throughout the process.

Watermark in Documents

Embed customizable watermarks to prevent unauthorized use and duplication of sensitive documents.

Aadhaar Masking

Automatically mask Aadhaar numbers to ensure privacy while maintaining document validity for KYC compliance.

Secured Image Viewer

Display documents and images in a protected viewer that restricts downloads, screenshots, and unauthorized access.

AIFISE OMNI

Real Time Analytics

Gain actionable insights into your KYC process with real-time analytics. Track performance metrics to optimize onboarding, improve customer experience, and enhance operational efficiency.

Success rate

Monitor the percentage of successful verifications to measure process efficiency and improve approval rates.

Drop Off's

Identify where users abandon the process to reduce friction and increase completion rates.

Response Time

Track verification speed to ensure fast, seamless onboarding with minimal wait times.

Benefits

Boost customer conversions while staying compliant

Our AI-powered solutions streamline your application journey, cut costs, prevent fraud, and enhance success rates—ensuring a seamless, secure, and delightful experience for your customers.

Frictionless application journey

Industry-leading encryption ensures that your data is secure and protected from threats.

Always Monitoring, Analysing & Evolving

Easily handle and upload large files without compromising speed or performance.

Stay compliant

Enjoy peace of mind with automatic backups occurring every minute to prevent data loss.

Our Differentiators

Unlocking Financial Expertise for Seamless Solutions

We understand BFSI space, not only technology providers but partners with you to provide end to end solution.

Deep Understanding of BFSI

End-to-End Solutions

Technology Providers & Strategic Partners

Tailored Solutions for Financial Success

Enhanced Speed and Trusted Data Security

Our verification system offers fast processing and top-level security, ensuring seamless onboarding and full compliance with data protection regulations like GDPR.

Fast Identity Verification

Advanced Data Security

Seamless Onboarding

Efficient Processing

Faster Time to Market (30 days)

Ready to deploy APIs, Mobile and Web SDKs to onboard our solution for you in 30 days.

30-Day API Deployment

Quick Onboarding in 30 Days

Accelerated Time to Launch

30 Days to Seamless Integration

COMPLIANCE

We Value Data Protection

We prioritize data protection in our KYC solution, ensuring the secure handling of customer information throughout the verification process.

End to end data encryption

Ensuring that all sensitive data is securely encrypted during transmission and storage, safeguarding against unauthorized access.

No data storage

We prioritize your privacy by not storing any personal information, ensuring no data is retained beyond the transaction.

Schedule Regular Vulnerability Checks

Our system undergoes scheduled vulnerability assessments to identify and resolve any potential security weaknesses.

Create audit trail

Every action is logged to maintain a transparent and traceable record, ensuring accountability and security.

Timely patching

We ensure that all system vulnerabilities are promptly addressed by applying security patches as soon as they are available.

List any certifications

Compliant with top security standards and certifications to ensure robust data protection.

Our Work

Till Date and Counting…

Tracking Progress, Milestones, and Continuous Growth

12 million+

Aadhar Masking

20 million+

Face Matches

2 million+

Aadhar QR Read

5 million+

e-KYC

Blog

Stay in the loop with the latest Fintech news, straight from the team.

Mar 2, 2026

Saurabh Kumar Sharma

Why Building KYC In-House Is the Biggest Technical Debt Fintechs Create

Build vs buy KYC in 2026? A deep regulatory and technical analysis covering CKYCRR 2.0, RBI amendments, DPDP Act impact, and the real cost of in-house compliance stacks.

Feb 26, 2026

Saurabh Kumar Sharma

CKYCRR 2.0: The Complete Blueprint for Banks, NBFCs & Fintechs

CKYCRR 2.0 marks a complete reset of India’s KYC infrastructure. From real-time APIs and AI-driven biometric checks to OTP-based consent and DPDP Act alignment, this guide explains what changed, why it matters, and how banks, NBFCs, and fintechs must prepare.

Powering Success

Customer Success Stories

Stay in the loop with the latest Fintech news, straight from the team.

July 8, 2025

Case Study: CKYC Automation for Indian NBFC

December 5, 2024

AIFISE Eliminated Manual Masking Delays

Try it yourself

Start your journey with AIFISE today!

Start your journey today and unlock the full potential of secure, efficient, and innovative solutions tailored to your business needs.