CKYC Automation

AI-Powered CKYC Solution for Regulated Entities in India

Automate CKYC workflows and cut operational time by 95% - from 7 days to just a few hours - while ensuring 100% RBI compliance with AIFISE’s AI-first platform.

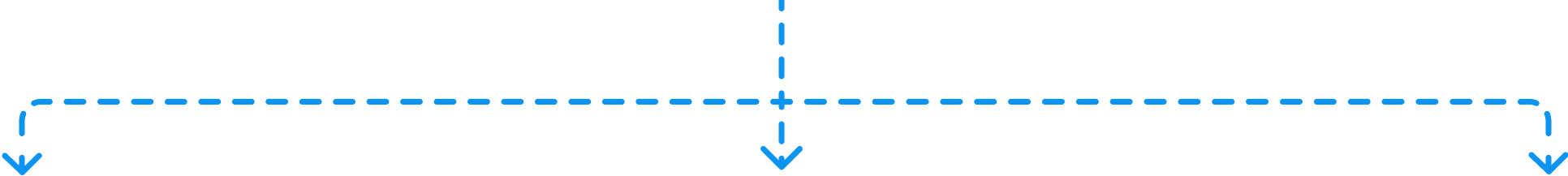

Automated Bulk KYC Upload and Download

AIFISE enables automated bulk upload and download of CKYC files using a secure Straight Through Processing (STP) workflow. The platform connects directly with your customer data repository, validates each record, and converts it into the compliant format required by CERSAI for bulk submissions. This reduces manual effort and improves operational accuracy at scale.

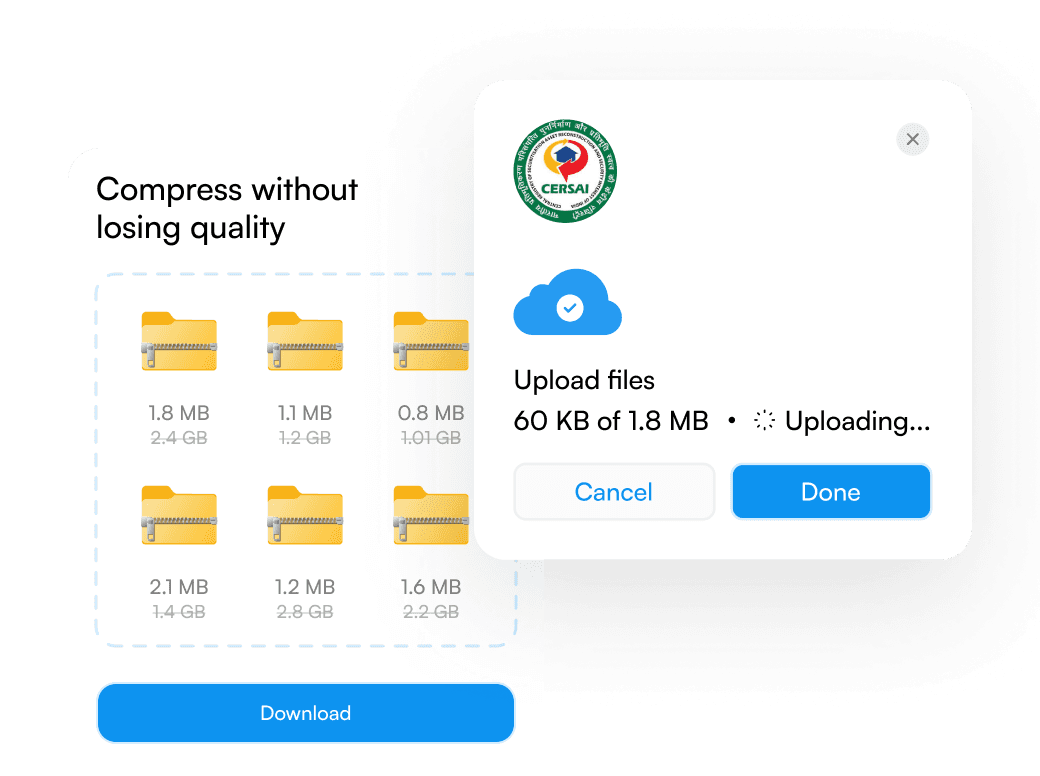

End to End CKYCR API Integration

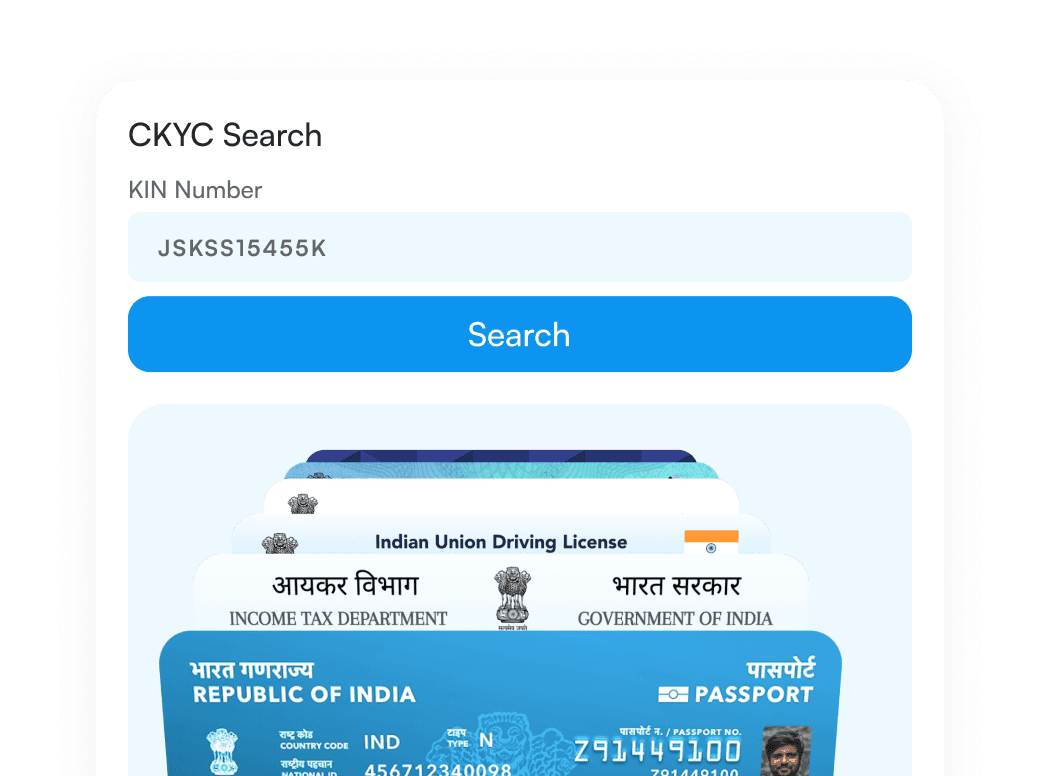

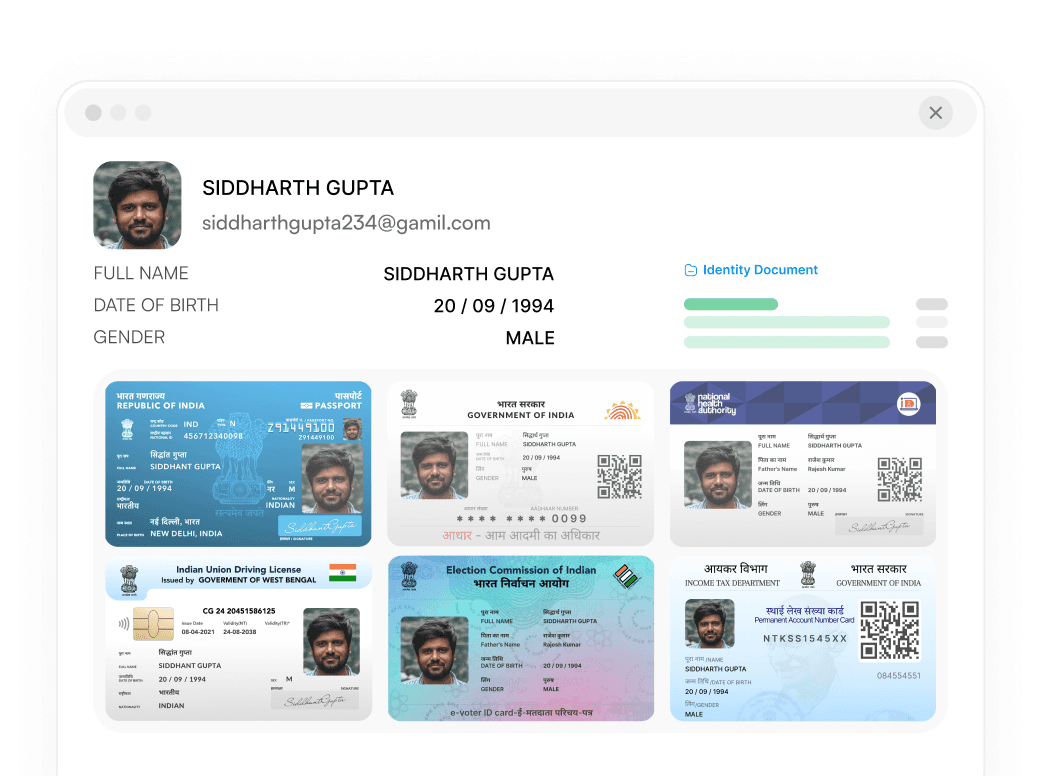

Our CKYCR integration engine is fully aligned with central registry guidelines. AIFISE connects your core banking or lending system with CERSAI for real time search, retrieval, and verification of customer KYC information. Institutions can instantly check CKYC availability and fetch verified customer profiles without manual intervention.

Intelligent API Based Search & Download Solutions

AIFISE supports secure IP whitelisting for both financial institutions and CERSAI. With an intelligent API look up mechanism, you can quickly verify if a customer’s CKYC number exists in the registry. The system also handles API based requests from partner institutions and auto generates structured customer responses for compliant information exchange.

Smart KYC Record Management

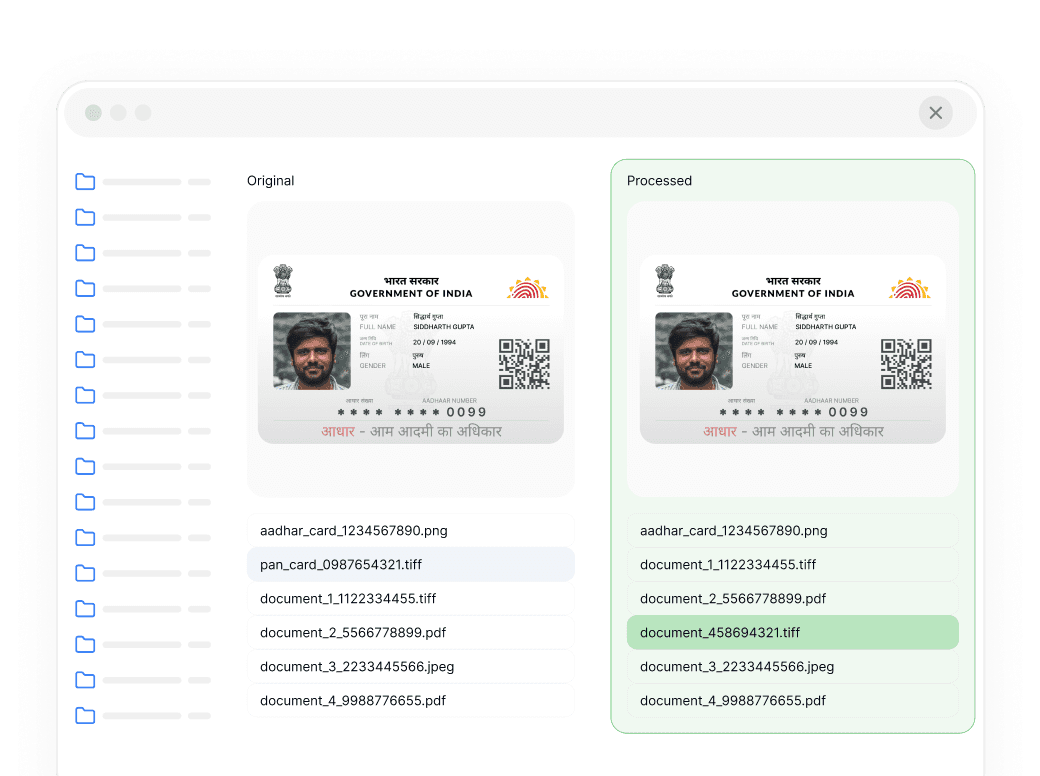

AIFISE provides an integrated Data Management System that stores and retrieves customer KYC history with complete traceability. The platform captures files through automated SFTP and intelligently identifies multiple OVDs belonging to the same customer based on parameters like date of birth, PAN, Aadhaar, driving license, and voter ID. This helps institutions maintain a clean and compliant CKYC repository.

Automated Checker and Maker Controls

Built in Checker and Maker controls ensure clean onboarding flows. AIFISE automatically validates records, detects duplicates, and helps institutions maintain high data integrity throughout the customer lifecycle.

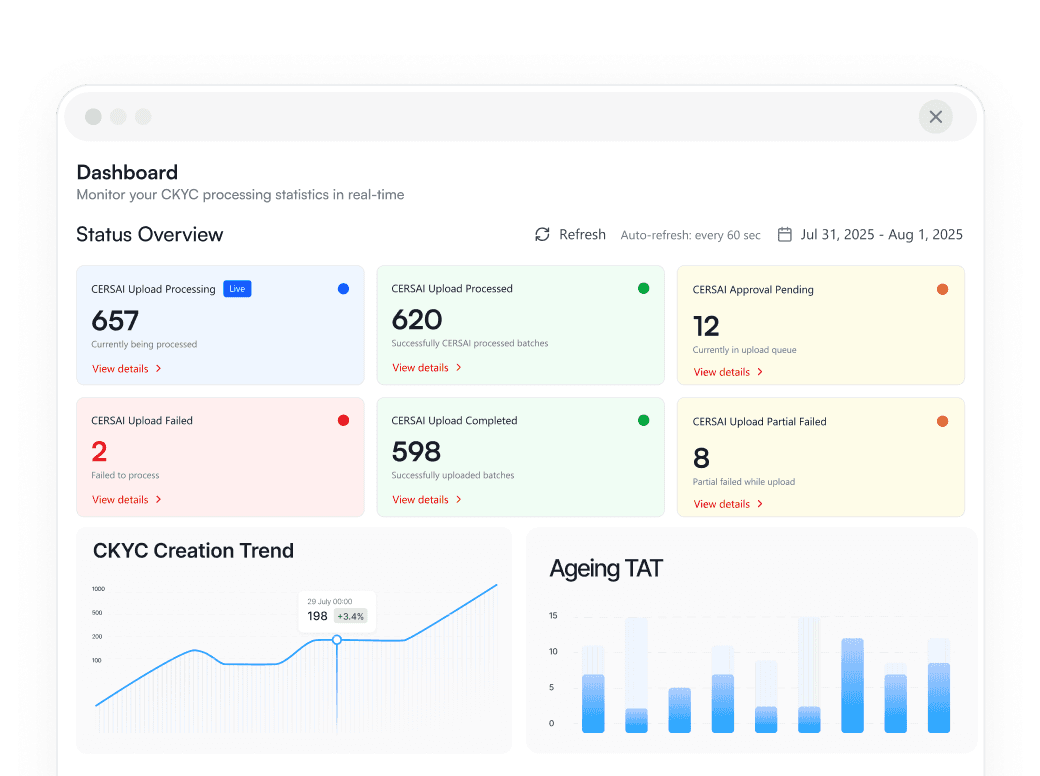

Real Time Analytics and Insights

AIFISE includes a real time MIS Dashboard that gives complete visibility into CKYCR activities. Track accounts opened, uploaded, approved, and rejected in real time. View branch and region wise performance. Identify probable matches, monitor notifications, and understand customer onboarding patterns with actionable insights.

Why CKYC, Why Now?

RBI’s KYC Master Direction (2025)

Mandates that all Regulated Entities (REs) periodically upload and maintain updated customer data with CKYCR.

Paragraph 56(h) of RBI’s Master Direction requires proactive updates; 56(j) restricts fresh KYC requests unless CKYCR is exhausted.

REs that adapt now will minimize risk, stay compliant, and improve customer experience across the board.

Top decision-makers are choosing solutions that move them forward.

AIFISE Advantage: Built for Speed, Compliance & Scale

AI Workflow Orchestration

Automates KYC steps end-to-end using ML, NLP & computer vision

Real-Time CKYCR Integration

Fully compliant with Paragraph 56 mandates, with live updates

Document Intelligence

Supports PAN, Aadhaar, Passport, Utility Bills, Bank Statements (or any other document included in your process)

Risk-Based Decisioning

Built-in predictive analytics to assess fraud or compliance risk

Multi-Language OCR & NLP

Supports Indian regional languages and diverse document types

Audit & Traceability

Granular audit logs, compliance exports, CKYCR reconciliation

Measurable Impact, Proven at Scale

From manual to intelligent: A transformation journey led by AIFISE.

Before AIFISE

After AIFISE Implementation

How It Works

AIFISE vs Other CKYC Vendors

The Tech Behind It

Learns from millions of KYC records to improve validation

Understands diverse document types & languages

Detects fraud patterns & auto-classifies documents

Flags high-risk customers for enhanced due diligence

Plug-and-play into your existing onboarding stack

AES-256 encryption, RBAC, audit trails, CKYCR token auth

Volume-Based,

Wallet-Friendly Pricing

Whether you process 10–100, 100–1,000, 1,000–10,000, or 10,000–100,000+ CKYC records, our platform scales instantly with your volume - no infrastructure, no overhead. Just plug, onboard, and grow.

Designed to Fit Your Scale,

Built to Power Your Future

AIFISE is India’s most advanced CKYC automation engine - trusted for high accuracy, RBI-aligned compliance, real-time CKYCR sync, and enterprise-grade security.

Designed for These Regulated Entities

Already trusted by industry leaders

After reading this section, if you still has questions,

feel free to contact us however you want.

Ready to future-proof your CKYC?

Let us show you how.